What is Cyber Insurance, And Why Do You Need It?

As more companies adopt virtual solutions, the likelihood of suffering cyber attacks rises. Such breaches have serious repercussions, including service disruption, data theft, loss of trust by customers, reduced sales, and litigation. Organizations are increasingly turning to cyber insurance as a viable mitigation strategy. Before implementing this solution, it's vital to understand what it is, how it works, and the benefits to your business.

As more companies adopt virtual solutions, the likelihood of suffering cyber attacks rises. Such breaches have serious repercussions, including service disruption, data theft, loss of trust by customers, reduced sales, and litigation. Organizations are increasingly turning to cyber insurance as a viable mitigation strategy. Before implementing this solution, it's vital to understand what it is, how it works, and the benefits to your business.

What is Cyber Insurance?

Cyber insurance is a type of coverage that shields your organization from the impact of cyberattacks. Also known as cyber liability insurance, it minimizes business disruption after a data breach. Although it potentially covers some financial aspects of the recovery, you're ultimately responsible for your company's cybersecurity.

Before signing up for cyber insurance, it’s advisable to understand the extent of coverage. While each provider may offer a unique policy, cyber liability insurance typically covers the destruction or loss of data. Other areas of interest include ransom or extortion demands, software or hardware damage, and crisis management.

What Factors Determine Cyber Insurance Pricing?

Cyber liability insurers analyze multiple variables before settling on cost. They include the nature of your industry, the number of employees, the extent of data coverage, and the cybersecurity measures already in place.

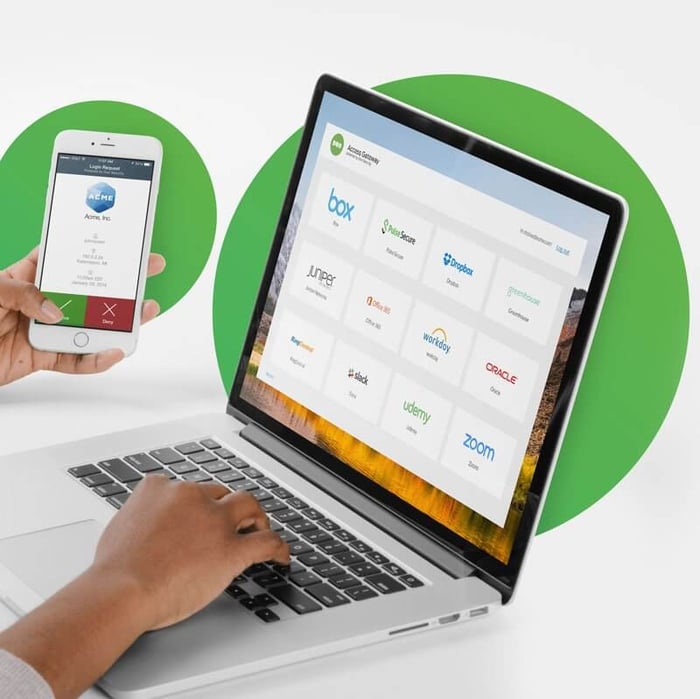

Although your insurer will shield you against losses arising from unauthorized access, it’s your responsibility to implement data protection measures. Multi-factor authentication (MFA) is one example of a simple, effective, and strong security foundation.

While large corporations often make headlines for suffering cyberattacks, small and medium enterprises are equally or more at risk. That's because they're less likely to implement the advanced security features that larger organizations can afford.

However, these solutions don't necessarily have to break the bank. Cisco's Duo Security offers affordable, intuitive, scalable, and reliable cybersecurity products that apply to organizations of all sizes.

How is Duo Compatible with Cyber Insurance?

Setting up MFA throughout your organization is a simple but crucial step in implementing a proactive security strategy. Duo is so convenient and easily scalable that most users barely notice it. It actively promotes the Zero Trust security framework.

This model prioritizes the authentication of all users, whether internal or external. Zero Trust is the best way to address data and IT infrastructure challenges. They include monitoring WFH employees, securing hybrid cloud environments, and preventing ransomware.

This framework is essential if your organization's infrastructure deployment includes unmanaged devices, legacy systems, SaaS applications, and multiple cloud types. In addition to curbing ransomware, it also helps stop supply chain attacks and insider threats.

Duo combines these solutions to secure all apps, devices, and users that access your network. In addition to verifying user identity, it confirms their devices are safe and compliant before granting access.

Who Needs Cyber Insurance?

Nearly all industries use online services to improve service delivery and facilitate transactions, which exposes them to cyberattacks. However, some are more vulnerable due to the sensitive data they receive, store, and process. They include finance, healthcare, higher education, manufacturing, retail, and hospitality.

According to various reliable technology analysts, data is the world's most valuable commodity. These organizations handle information that fetches a pretty penny in the black market. Examples are credit card, customer address, bank account, contract, product concept, enrollment, marketing strategy, and insurance claim details.

Bad actors also target servers that hold personally identifiable information (PII) such as addresses, social security numbers, names, and billing information. They use various tactics to gain illegal access. Examples include cyber espionage, ransomware, DDoS attacks, card skimming, and misuse of privileged access.

How Cyber Insurance Accelerates Recovery Efforts after a Breach

Even with the best security features in place, your organization might still suffer an attack. Breach discovery refers to the period when you become aware of an attack. The sooner you do, the higher the likelihood of containing it and avoiding devastating losses.

Apart from the possibility of paying a ransom, you have other expenses to consider during this period. They include notifying users of the breach, hiring experts to repair compromised data, and updating details of customers with compromised PII. You might also have to set aside fees to cover any legal action arising from privacy violation lawsuits.

Most cyber insurance policies clearly outline the aspects of your recovery that they’ll cover. A successful claim will depend on various factors, including your history of cyberattacks, response to known vulnerabilities, and the role of employees, contractors, and other insiders.

Take Action Now

A proactive cybersecurity approach is essential to a successful cyber insurance policy. While assessing your risk status, a potential insurer will determine whether you meet their minimum security requirements. Cisco's Duo not only makes this assessment easier but also improves the likelihood of paying lower premiums. Duo's scalable nature means you don't have to worry about attacks as your company grows. Sign up today to enjoy its full benefits.

-(16).png)

-(12)-kozfp.png)